How to Interpret Financial Statements

As an investor, the goal is always to find companies with a sustainable competitive advantage and a well-thought-out strategy. Financial statement can help you identify these companies, if you know where to look and how to interpret them. Therefore, I will cover some of the key elements to look at when you are going over the financial statements.

Before we dive in, I want to mention a few general concepts that are core to my investment strategy.

In general, my desired holding period is forever. This means investing now in those companies that will be relevant in the future. For example, when I picture the future, 20 or even 30 years from now, what are some things I see being crucial and present in that future. Personally, I don’t think there will be any traditional cars or a coal industry, so I don’t look at them as an investment. What I do see in the future are technology driven transportation or soda, so I will look at those industries and their supply chain.

I like consistency over the past 5 years, and for my more “growth” investments I look at the past 3 years. I like to see consistency in: earnings(growth), debt-levels (low), profitability, and efficiency.

I also care about the length of existence. I tend not to take too many risks in new startups, and yes, I might forego some potential huge winners, but I also avoid the big losses, and those are much more numerous in my opinion. Evaluating and predicting the trajectory of startups is something I am not good at, so I stay away from those things. Additionally, the longer you have been around, the more experience is incorporated in internal training procedures, customs, etc.

Now let’s get started! I will use the Microsoft (MSFT) financial statements as an example, but I am not making any investment recommendations. MSFT is used just as an educational reference firm and you should always do your own research before making an investment decision. You can find these financial statements on the SEC website, but I prefer going to the company’s website, search for the investor relations tab and select annual reports. You want to start your investigation by analyzing the 10K statements.

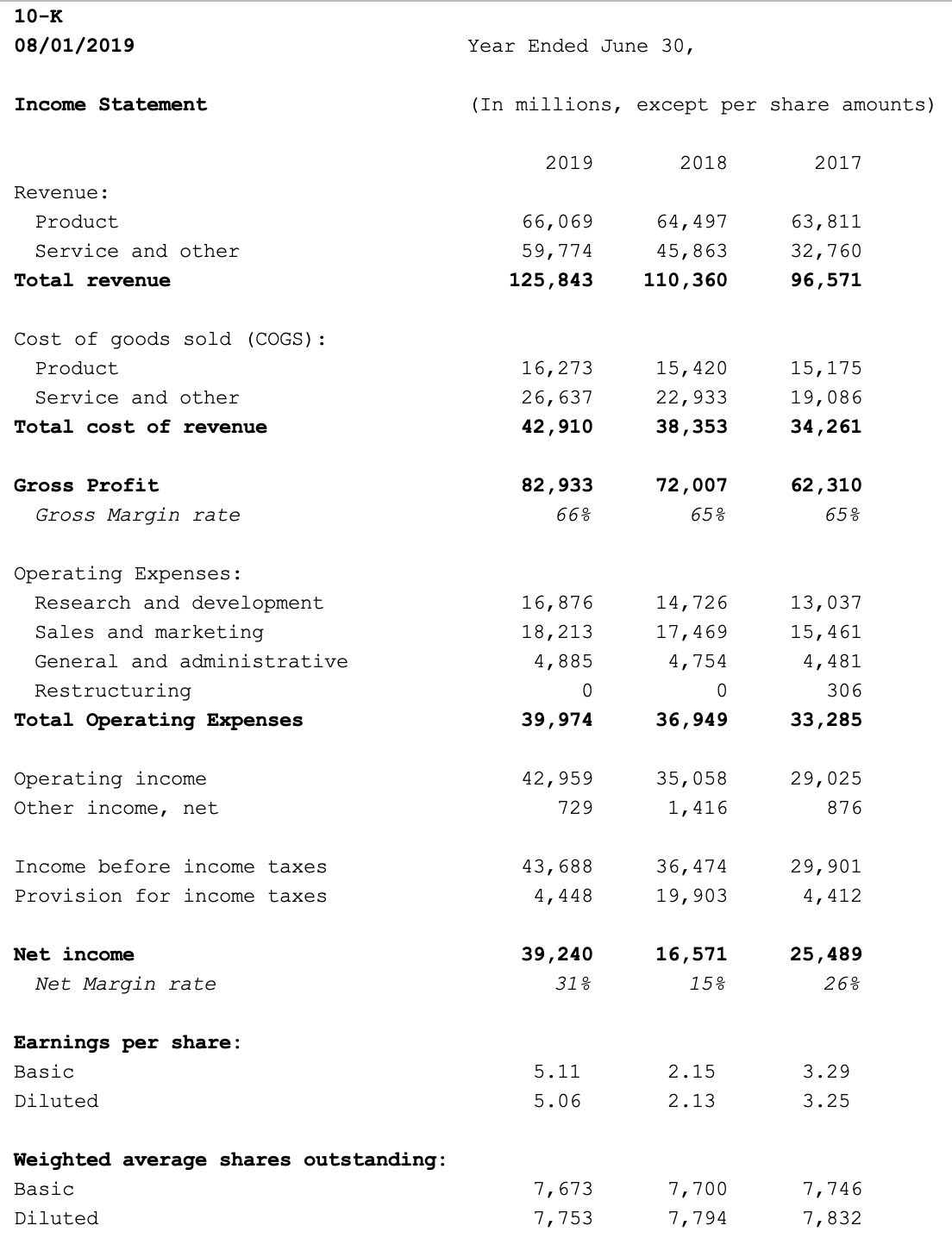

The income statement

The income statement (I/S) provides an overview of the firm’s income over a specified time period and it focuses on 4 items: revenues, expenses, gains, and losses. The starting point of the I/S are the revenues or sales, it takes into account expenses and finally gives us a figure for the firm’s net income and consequentially earnings per share (eps).

Net income = (Total Revenues + Gains) – (Total expenses + Losses)

These are the basics. However, we can further divide revenues into 1) operating and 2) non-operating revenues, and our expenses can be further divided into 1) primary expenses and 2) secondary expenses. In a later blog I will go into much more detail, but for now I think this is a good starting point for the beginning investor.

MSFT - 10K

When you analyze an income statement as a beginning investor it might seem a little overwhelming, or you might not know what to do with it. Therefore, we’ll start with some of the more basic things that will definitely help you in the long run.

Net income growth: Ideally, we want to see consistent growth in net income. This indicates that they are becoming more profitable, which is a good sign for the investor. It is always interesting to figure out whether this is due to an increase in revenue or a reduction in expenses. Depending on the reason, they could tell us different things and it is something that we need to be cognizant off. For example, increase in revenue could be due to increased marketing activity, but a decrease in costs could be due to an increase in efficiency or management knowledge.

Gross margin rate: (revenue – cost of goods sold) / revenue

This is also a profitability measure and it tells us how much money the firm is able to retain from their revenues. The higher this number, the better. We ideally want to see a rate higher than the industry average, but more importantly, we want the number to be consistent. If it fluctuates, it increases the uncertainty of future rates.

Net margin rate: net profit / total revenues

This measure is similar to the gross margin rate, but it also takes into account the operating expenses. These are expenses that are not directly related to the products but includes the cost of marketing and salaries. These are costs that are assumed to occur roughly independent of the number of products sold or produced. This number will always be smaller than the gross margin rate. A large difference could mean trouble, especially when revenues decline, and the firm still has this large chunk of expenses. Ideally, we are looking for a percentage above 20% (might be different for certain industries) and above the industry average.

For those who want to try something a little bit more advanced: try to adjust the revenues for inflation. Select one year as your base year (ex. 2017) and adjust all the previous and following revenues for inflation. This will give you a more exact measure of the firm’s growth in revenues. Send me an email if you want to see a post or video on how to do this.

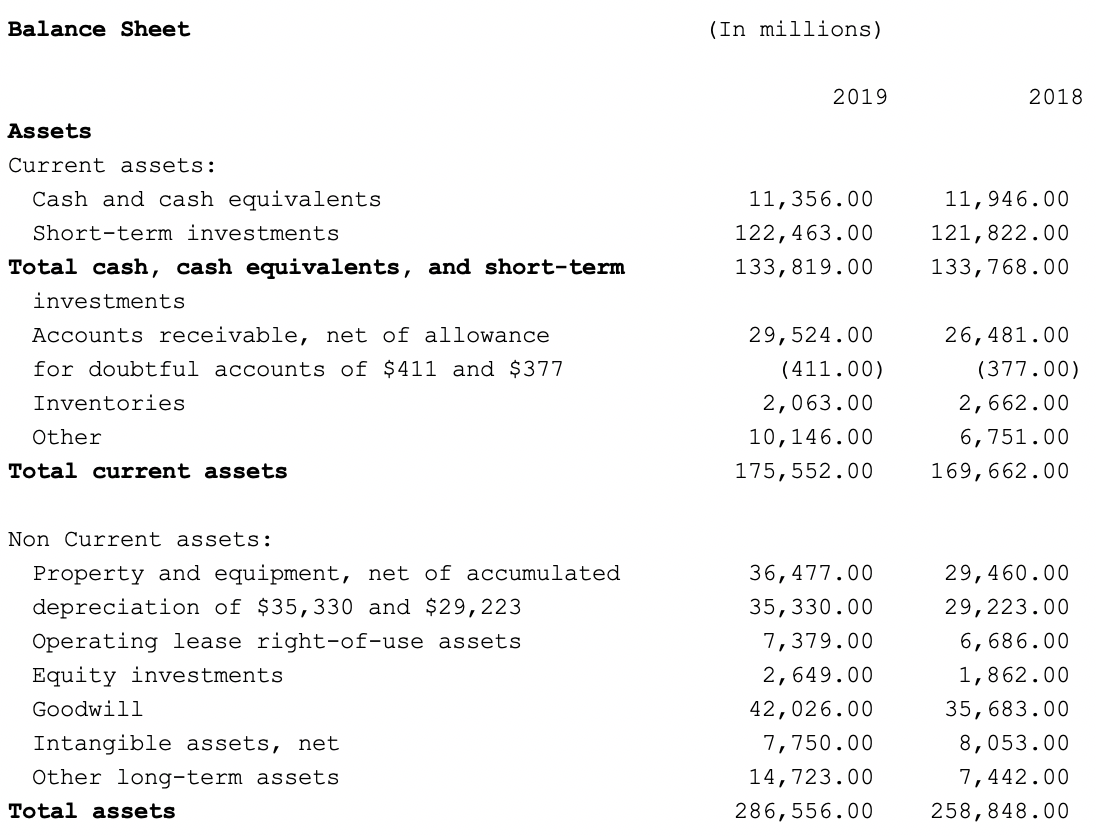

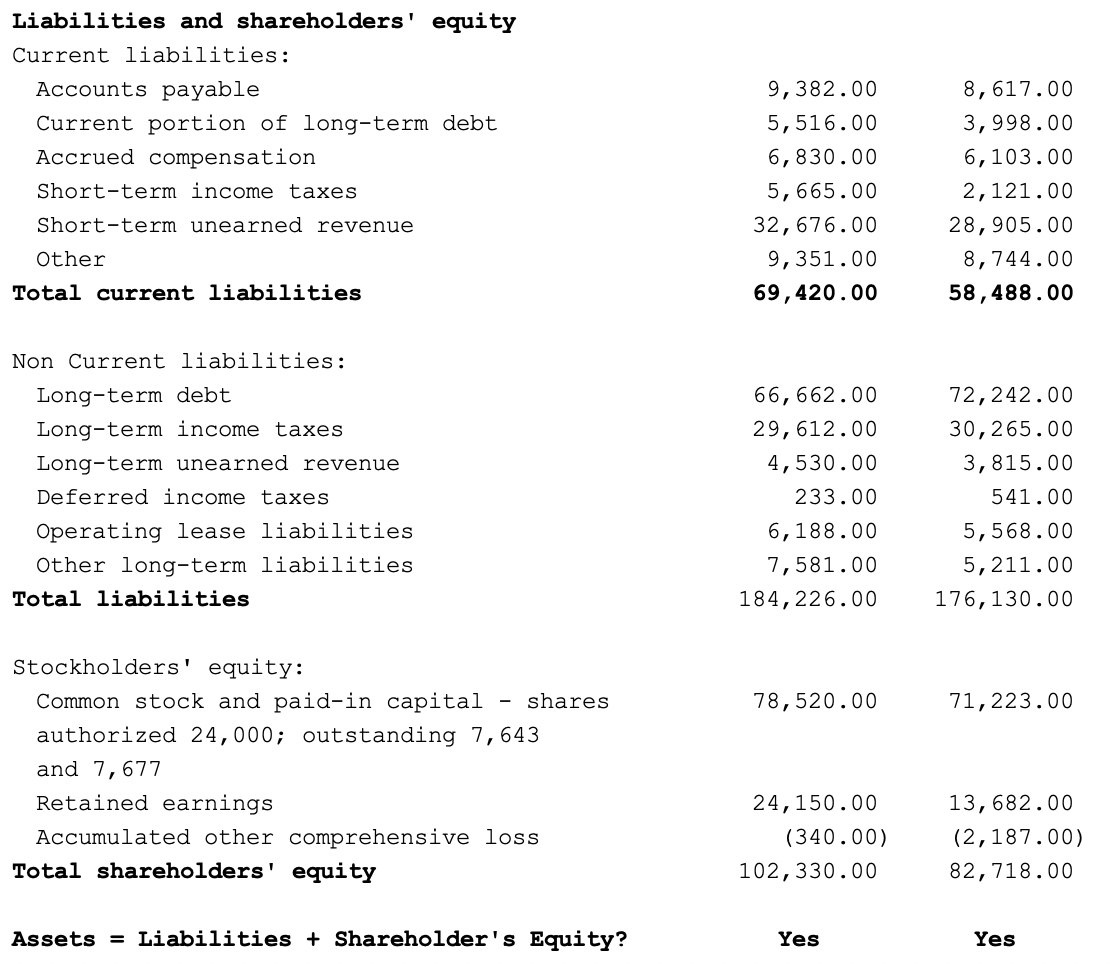

The Balance sheet

Unlike the I/S, the Balance Sheet (B/S) does not provide a representation of a certain time period, but an exact snapshot in time. It reports the company’s assets, liabilities, and shareholders’ equity at this specific point in time and it can be used as a valuation technique. This statement also provides the basis for a lot of fundamental financial ratios. For those with an accounting background or interested in learning about accounting and financial statements (which I suggest you should) the important rule to remember is:

Assets = Liabilities + Shareholders’ equity

With:

Assets: cash, inventory, property, …

Liabilities: rent, wages, utilities, loans, …

Shareholders’ equity: retained earnings, …

Each of these categories is further divided into smaller accounts, such as current (maturity < 1 year) and non-current (maturity > 1 year) accounts. This is also a basic overview and just like the I/S above, I will write another blog going into much more detail. However, for current purposes, this will suffice.

Retained earnings: beginning retained earnings + net income – (Cash dividends + stock dividends).

This is the amount of net income left over after the company has paid their dividends to their shareholders. Positive retained earnings are funds for the company to invest in research & development or other opportunities that could increase the value of the firm, therefore retained earnings are a very important indicator for potential future growth of the company. We would like to see a steady and consistent increase in this number. However, we can make an exception if management has increased dividends or engaged in share buybacks, which increases the value for shareholders.

We want the firm to be efficient, and we use 2 important metrics for this:

ROA: return on assets = net income / total assets

It provides us with comparable number of how well the firm is using its assets to generate income. The higher the better. We want this to be above the industry average and not in decline. We want to invest in a company that is able to make efficient use of its assets rather than waste an opportunity. I prefer this metric over ROE, because it also takes into account the company’s debt. That being said, I also use ROE as a beginning point to start my investigation.

ROE: return on equity = net income / shareholder equity

Similar to ROA, ROE measures the efficiency of the firm, but now it indicates how efficient the firm uses the shareholders’ equity. This is a number that should only be used to compare within industries. However, as a general rule, I’d like to see an ROE larger than the S&P 500 average annual return (12%), otherwise I could have just invested in an index fund tracking the S&P 500.

Side note: Warren Buffett uses the return on net tangible assets, which eliminates intangible assets such as goodwill and intellectual capital.

Quick ratio: (current assets – inventories)/current liabilities

This is an indicator of a company’s ability to pay its short-term debt obligations. This is important, because if a crisis were to happen they need to be able to pay off their debts that are due within one year if they want to prevent insolvency (the current Covid-19 crisis is an excellent example, especially the airline industry). The higher this ratio, the better. As a minimum I like to see a value above 1.5, but preferably above 2. If this number is below 1, it means that the company is unable to pay of their short-term obligations using just their assets (excluding inventory). I prefer this measure to the current ratio, which does not deduct the inventories from the current assets. The reason I prefer quick to current is because when the company is forced to pay their debt, we cannot always assume that they are able to sell all their inventory at normal prices, they might be forced to offer large discounts, reducing the value.

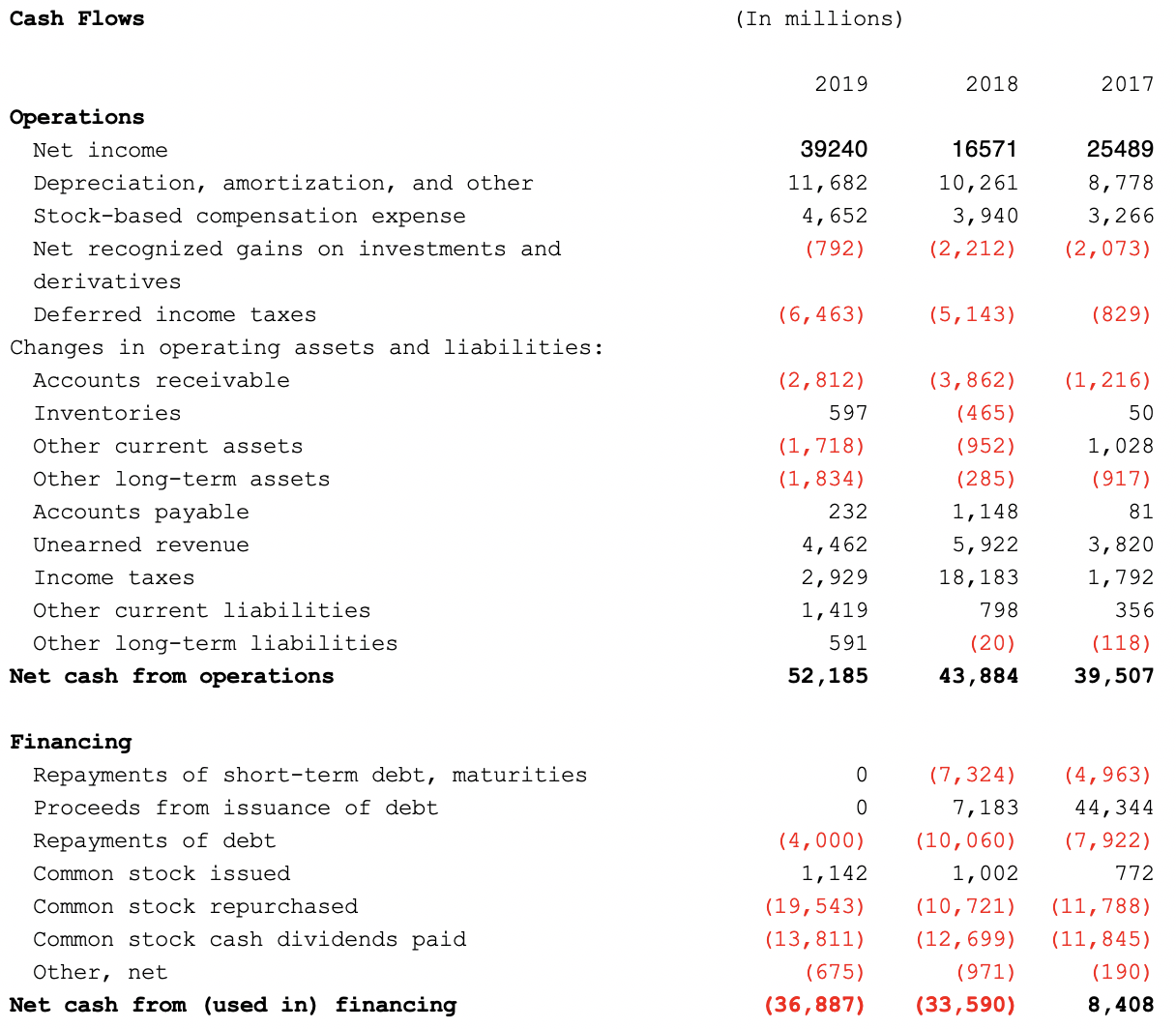

Cash Flow Statement

The third statement, the cash flow statement (C/F), reports an overview of all the cash inflows from their regular business, investment, and finance activities. It allows the analysts to take a closer look at all the transactions that the business conducts and that contributes to the success or failure of the business. These cash activities are divided into 3 main sections:

Cash flow from operations: income, taxes, …

Cash flow from financing: debts, common stock, …

Cash flow from investing: acquisitions, property and equipment purchases, …

This might sound similar to the I/S as the beginning investor, however, there is one crucial difference. The I/S follows the accrual-based accounting method, while the C/F follows the cash based method. This is a very important difference, and one that I will address in a separate post as well. However, for brevity and as to not confuse too much, I will keep it simple here.

The main things we like to investigate here are:

The number of acquisitions, I personally do not like a serial acquirer as they tend to overpay for their investment and are difficult to value in my opinion. Also, empirical research has shown that the acquirer experiences a decline in stock price as the market shows a lack of confidence in this endeavor.

Capex: = change in property, plant, and equipment + current depreciation

It tells us something about how aggressive the firm is expanding and how much they are paying for it. Some expansion is good, as it provides opportunities for future growth, but too much might mean they are outpacing themselves and not giving dedicated focus to one avenue of growth. A negative number could mean that they are shrinking, this is not necessarily a bad thing, but we need to know why this is happening. You can find most of the information in the annual reports, the 10-K. Ideally, I like to see a number below 20% of retained earnings.

As I’ve mentioned in my other posts, these metrics are just the beginning. If something is not as it should be, such as lower reduced earnings, always investigate why this is. Or a high Capex, how did this happen? Was it justified?

Learning how to use Excel for financial modeling will turn out to be a valuable and time saving skill when analyzing the financial statements. Also, a basic understanding of introductory financial accounting will increase your investment skills exponentially.

Finally, there are times where I do not follow the forever holding period rule, these are:

When there is a better investment opportunity.

When the firm loses their competitive advantage. It doesn’t matter if it is because of legal, environmental, or other reasons.

When the market overvalues the company, such as a ridiculous high P/E ratio. Yes, this can keep growing in the near future, but I personally don’t like the risk/reward level. I want to invest, not speculate. I am in it for the long-run, not to get rich quickly.

I covered a lot of elements in this post, but I also left out a lot of important elements. However, it is my opinion that the things and ideas that I mentioned are crucial for the starting investor. In the future I will cover some of the topics above in much more detail in separate posts.

As always, let me know what you think, whether you agree or disagree, or if you have other recommendations that you think are crucial or that helped you when you first started.